Offshore Trust Services for Beginners

Wiki Article

Some Of Offshore Trust Services

Table of ContentsFascination About Offshore Trust ServicesAbout Offshore Trust ServicesThe 10-Minute Rule for Offshore Trust ServicesWhat Does Offshore Trust Services Mean?The Only Guide for Offshore Trust Services

Also if a financial institution can bring a deceitful transfer case, it is challenging to do well. They must prove past a sensible question that the transfer was made with the intent to defraud that certain financial institution which the transfer left the debtor financially troubled. Several offshore asset defense plans entail greater than one lawful entity.

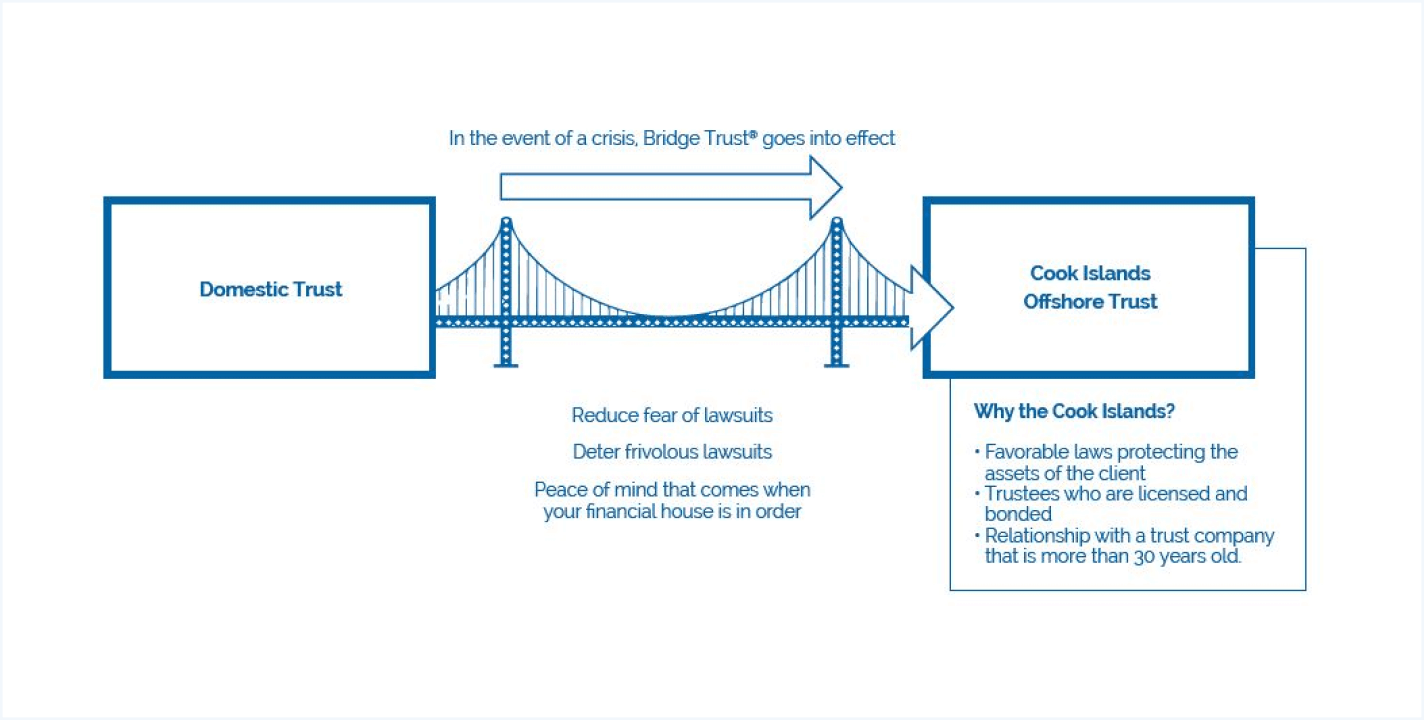

, which for some time has actually been a favored LLC jurisdiction. Current adjustments to Nevis tax obligation and declaring needs have led to LLCs in the Cook Islands.

The person could next develop a Chef Islands count on making use of an overseas trust business as a trustee. The LLC concerns subscription passions to the trustee of the Cook Islands count on.

With this kind of overseas trust fund framework, the Nevis LLC is handled by the United state person when there are no expected legal actions. Once a legal concern arises, the trustee of the overseas depend on must remove the United state

Provide all needed documents for the trustee's due diligence. Compose the overseas trust document with your attorney. Fund the trust by transferring domestic assets to the offshore accounts. The very first step to forming an offshore depend on is choosing a count on jurisdiction. offshore trust services. In our experience, the Cook Islands uses the very best mix of trustee policy, positive borrower regulations, as well as favorable litigation outcomes contrasted to other territories.

The trustee firm will certainly use software program to verify your identity and also explore your present legal situation in the united state Depend on business do not want customers that might include the business in investigations or lawsuits, such as disagreements including the U.S. government. You must disclose pending litigation as well as examinations as component of the background check.

Excitement About Offshore Trust Services

The majority of people pass the background check without concern. Your domestic property protection attorney will deal with the offshore trustee firm to draft the offshore trust arrangement. If you consist of other entities in the framework, such as a Nevis LLC, the lawyer will also compose the arrangements for those entities. browse this site The trust contract can be tailored based on your possession defense and estate preparation goals.

audit firms, and also they use the audit results and their insurance coverage certificates to possible overseas depend on customers. Most individuals would love to keep control of their own assets held in their overseas count on by having the power to remove and replace the trustee. Preserving the power to change an overseas trustee creates legal risks.

A court could order the debtor to exercise their maintained civil liberties to replace a creditor agent for the present overseas trustee. Overseas depend on possession security functions best if the trustmaker has no control over count on assets or other celebrations to the count on. The trustmaker should not preserve any kind of powers that they might be compelled to exercise by a UNITED STATE

The Facts About Offshore Trust Services Uncovered

Some trustee business permit the trustmaker to reserve key discretion over depend on investments as well as account administration in the setting of trust fund consultant. This plan offers the trustmaker some control over assets conveyed to the depend on, as well as the trustmaker can offer up civil liberties if they are threatened with legal activity, leaving the offshore trustee in single control.The trustmaker does not have straight accessibility to overseas count on monetary accounts, but they can request circulations from the offshore trustee The possibility of turn over orders as well as civil ridicule charges is a considerable risk in overseas asset defense. Borrowers depending on overseas depends on need to take into consideration the opportunity of a domestic court order to restore assets moved to a debtor's offshore depend on.

A court will not send to prison a person for failing to do something that can't be website here done. In instances when a court orders a debtor to take a break an overseas trust plan, the borrower can claim that compliance is difficult since the depend on is under the control of an offshore trustee. But it's not as basic as invoking an impossibility protection and also stating, "I can't." Some current court choices deal with a transfer of possessions to an overseas trust as a willful act of developing an unfeasibility.

The Fannie Mae company obtained a cash judgment versus the borrower. The debtor had actually moved over $7 million to an overseas trustee. The trustee after that transferred the exact same money to an international LLC of which the debtor was the single participant. check my site The court got the debtor to restore the money to pay the Fannie Mae judgment.

Things about Offshore Trust Services

The offshore trustee rejected, and he claimed that the cash had been bought the LLC (offshore trust services). The court held the debtor in ridicule of court. The court located that in spite of the rejection by the offshore trustee, the borrower still had the capacity to access the funds as the sole participant of the LLC.Report this wiki page